title: Vnpy tutorial 0x06 backtest description: Vnpy Quant Tutorial, Backtest keywords: Vnpy, quant tutorial, backtest date: 2024-09-05 category: "quant"

Warning: This page is translated by MACHINE, which may lead to POOR QUALITY or INCORRECT INFORMATION, please read with CAUTION!

After the data is connected according to [[vnpy_tutorial_0x02_futu]]]

Open the recovery system: Function -> CTABACKTESTER

- Strategy Strategy: Hackstrategy

- VTSYMBOL Local Code: Enter 00700.sehk

- Start date Start time: 01/01/24

- Fear rate: 0.000025

- SIP PAGE transaction inventory: 0.2

- SIZE contract multiplication 300

- Price Tick price beating 0.2

- CAPITAL Returga Back Testing funds: 1000000.0

Enter 0.000025 (0.25) in the handling rate editing box, 0.2 input of the transaction slippery point (that is, a slide cost of a unilateral transaction 1 jump), the contract multiplication is 300 (300 yuan each point), the price jump is also 0.2 (stock index futures futures futures (stock index futures futures The minimum price changes), we use 1 million for the recovery funds.

Click the "Start Test" button to pop up the parameter configuration dialog box:

- Then click Start Backtesting

The Fast_window and Slow_window here are the parameter names we added to the parameters list before. Our back test engine will automatically start the entire process of the strategy back test:

Load data, data back, simulated matching, calculate daily profit and loss, statistical indicators,

finally draw a chart:

13:03:21 Initializing BacktesterEngine

13:03:21 Strategies imported

13:03:27 ----------------------------------------

13:03:27 Start loading historical data

13:03:27 Loading progress: # [0%]

13:03:28 Loading progress: # [10%]

13:03:28 Loading progress: ## [20%]

13:03:29 Loading progress: ### [30%]

13:03:30 Loading progress: #### [40%]

13:03:31 Loading progress: ##### [50%]

13:03:32 Loading progress: ###### [59%]

13:03:33 Loading progress: ####### [69%]

13:03:34 Loading progress: ######## [79%]

13:03:35 Loading progress: ######### [89%]

13:03:36 Loading progress: ########## [99%]

13:03:36 Historical data loading completed, data count: 89852

13:03:36 Strategy initialization complete

13:03:36 Start replaying historical data

13:03:36 Backtesting progress: = [0%]

13:03:36 Backtesting progress: == [10%]

13:03:37 Backtesting progress: === [20%]

13:03:37 Backtesting progress: ==== [30%]

13:03:37 Backtesting progress: ===== [40%]

13:03:38 Backtesting progress: ====== [50%]

13:03:38 Backtesting progress: ======= [60%]

13:03:38 Backtesting progress: ======== [70%]

13:03:39 Backtesting progress: ========= [80%]

13:03:39 Backtesting progress: ========== [90%]

13:03:39 Backtesting progress: =========== [100%]

13:03:39 Historical backtest complete

13:03:39 Start calculating daily mark-to-market profit and loss

13:03:39 The daily mark-to-market profit and loss calculation is complete

13:03:39 Start calculating strategy statistical indicators

13:03:39 Strategy statistical indicators calculation completedcompleted```

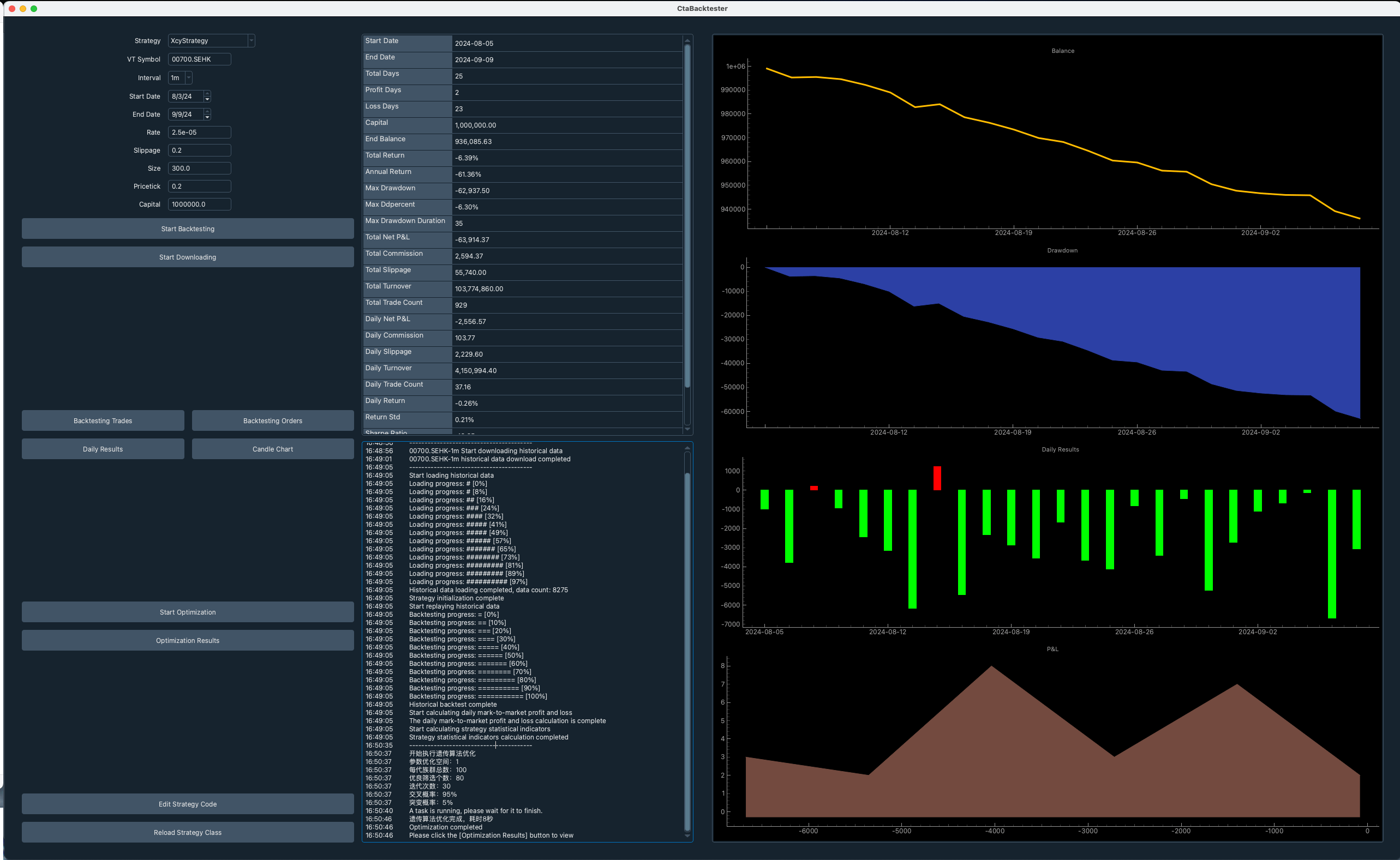

- 子图1:资金变化曲线,笔直向下说明稳定亏损

- 子图2:最大回撤曲线,越来越大说明策略亏损越来越多

- 子图3:每日盈亏统计,红绿分布平均,但绿色密度更大(亏损)

- 子图4:盈亏的概率分布图,尖峰在0轴左侧(中位数日期发生亏损)

中间的数据说明

| 功能 | 数据 |

| ---------------------------- | ----------------- |

| 首个交易日 | 2016-08-15 |

| 最后交易日 | 2019-07-31 |

| 总交易日 | 721 |

| 盈利交易日 | 265 |

| 亏损交易日 | 456 |

| 起始资金 | 1,000,000.00 |

| 结束资金 | -1,204,558.24 |

| 总收益率 | -220.46% |

| 年化收益 | -73.38% |

| Max Drawdown最大回撤 | -2,219,999.08 |

| Max Drawdown Duration百分比最大回撤 | -220.15% |

| Toal Net P&L总盈亏 | -2,204,558.24 |

| Total Commission总手续费 | 519,338.24 |

| Total Slippage总滑点 | 1,154,700.00 |

| Total Turnover总成交额 | 20,773,529,520.00 |

| Total Trade Count 总成交笔数 | 19245 |

| 日均盈亏 | -3,057.64 |

| 日均手续费 | 720.30 |

| 日均滑点 | 1,601.53 |

# 功能说明

* Backtesting Trades 回测交易

* Backtesting Orders 回测订单

* Daily Results 每日资金数据结果

* Candle Chart 蜡烛图

* Start Optimization 开始优化

* Optimization Results 优化结果

* Edit Strategy Code 编辑策略代码

* Reload Strategy Class 重新载入策略代码

# 策略自定义参数

在HackStrategies.py中,改数据

```python

# Definition parameter

Fast_window = 10

Slow_window = 20

+test_window = 30

# Definition variable

FAST_MA0 = 0.0

FAST_MA1 = 0.0

Slow_ma0 = 0.0

Slow_ma1 = 0.0

+test_ma0 = 0.0

+test_ma1 = 0.0

# Add parameter and variable name to the corresponding list

#parameters = [[["fast_window",,"slow_window"]

parameters = ["fast_window",,"slow_window",,"test_window"]

#variables = [[["fast_ma0",,"fast_ma1",,"slow_ma0",,"slow_ma1"]

variables = ["fast_ma0",,"fast_ma1",,"slow_ma0",,"slow_ma1",,"test_ma0",,"test_ma1"]

下面的Start Optimization 开始优化章节会提到。

Start Optimization 开始优化

点start Backtesting(开始回测)

我们想要看看

-

fast_window,从2到20(步进2),

-

slow_window,从20到100(步进10)

-

test_window,先不管。

-

step:增加步数。例:开始1,结束100,步数为2,那么1,3,5,7

-

Brutal force optimization暴力穷举优化:把所有可能都显示一次

-

Genetic algorithm optimization遗传算法优化

我们选择Brutal force optimization暴力穷举优化开始跑数据,等待结果出来

查看优化结果,点击Optimization Results 优化结果可以看见哪个参数的效果最好。

fast_window数据:30 slow_window数据:90

效果最好,亏得最少。只有-17%,本来亏损是64%,进步很大 2 本来